How to secure your bank account from hackers: A complete protection guide

You can now manage your bank account from almost anywhere. Whether you’re on the couch watching TV or waiting in line at the store, online and mobile banking make it simple to deposit checks or pay bills.

But this convenience comes with risks, as cybercriminals are constantly finding new ways to steal personal information and break into bank accounts. For example, scammers send fake emails pretending to be your bank or use spyware to capture your login details.

The good news is that there are steps you can take to avoid becoming a target. This guide will show you practical ways to secure your bank account: follow these tips to protect your money and your identity while banking online.

What you need to know before securing your bank account

The rise of financial cybercrime

Financial cybercrime keeps growing and getting more complex. Criminals use tricks like phishing emails, text messages, and phone calls to obtain your personal details by pretending to be your bank.

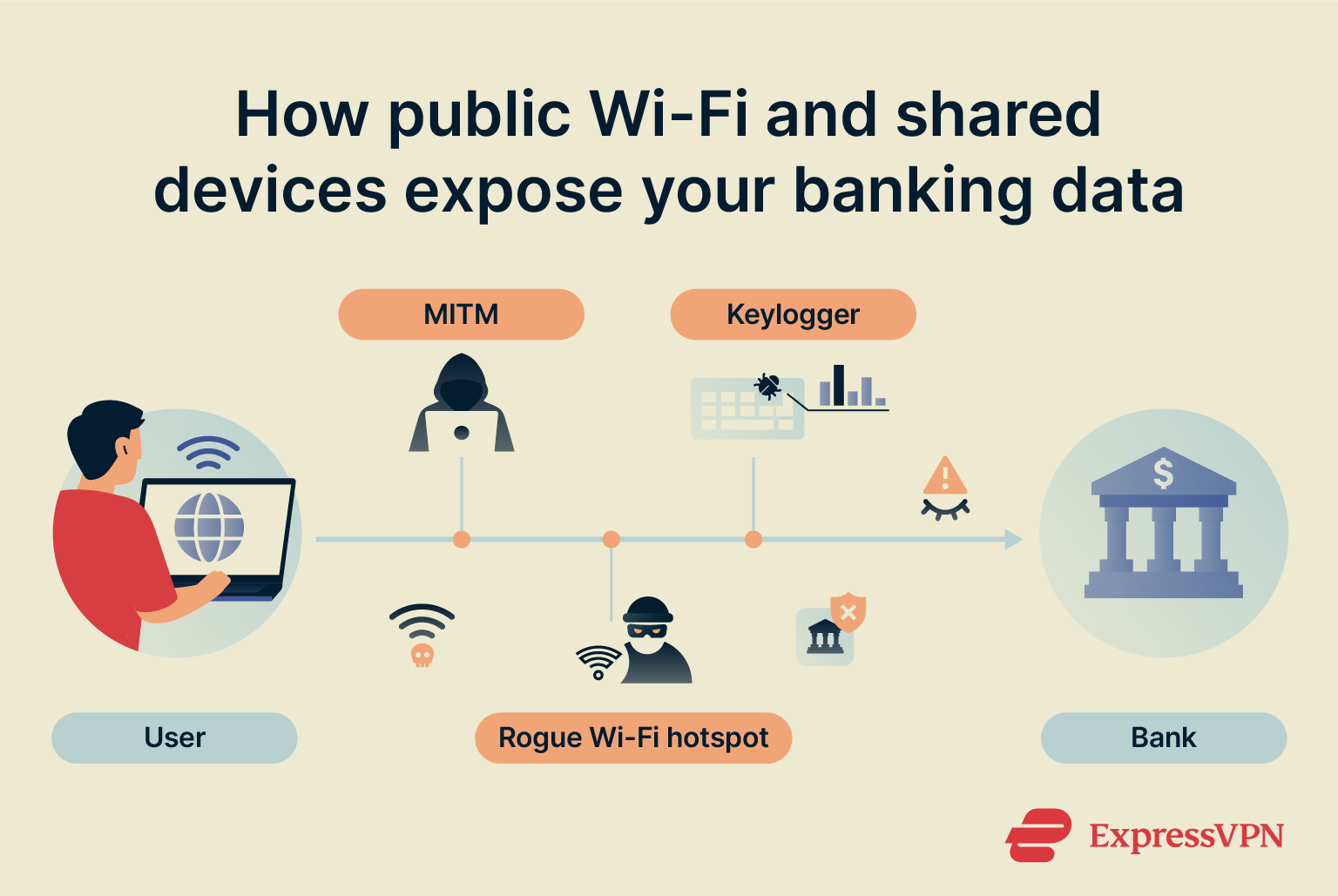

There are also a multitude of fake banking websites and apps out there designed to steal your info. What’s more, banking over public Wi-Fi without a virtual private network (VPN) leaves you vulnerable to man-in-the-middle attacks (MITM) that can steal your login credentials or hijack your transactions.

Credential stuffing (using stolen usernames and passwords from other breaches) is another widespread tactic, as many users reuse passwords across accounts.

Overall, the risk to your financial information is higher than ever, making it crucial to stay alert and protect your accounts with strong security measures.

What’s at stake?

Financial cybercrime has serious consequences for individuals and businesses alike. When cybercriminals gain access to your banking information, the damage goes beyond just stolen money. Here are the main risks:

- Identity theft: Criminals use stolen personal data to impersonate victims, open new accounts, apply for loans, or make unauthorized transactions. This can lead to long-term financial and reputational harm.

- Drained accounts: Unauthorized withdrawals can leave your checking or savings accounts empty, affecting your ability to pay bills or meet other financial obligations.

- Credit damage: Fraudulent activities like unauthorized loans or credit card charges can hurt your credit score, making it harder to get mortgages, loans, or other financial products in the future.

- Recovery time and stress: Dealing with the fallout from cybercrime often takes months. Victims must work with banks, credit bureaus, and law enforcement to restore their finances and identity.

- Financial losses beyond theft: Some cyberattacks cause indirect costs, such as late fees, bounced payments, and lost income due to disrupted banking access.

- Increased security measures: Victims often need to adopt additional security tools and monitoring services, which may involve extra costs and ongoing effort.

How hackers break into bank accounts

Cybercriminals use several techniques to gain access to bank accounts. As these attacks become more sophisticated, understanding how they operate is essential to protect your financial information and prevent unauthorized access.

With the rise of digital banks, it’s even more important to understand how these services work so you can verify legitimate platforms and avoid fraud.

Phishing scams and social engineering

Phishing scams use emails, text messages, or phone calls that pretend to be from your bank or another trusted source. These messages try to get you to share personal information like usernames and passwords. They often try to create urgency or fear to prompt quick action.

These types of scams have been increasing in frequency and sophistication with the advent of AI, and they can lead to significant financial losses. Being cautious with unsolicited messages and verifying the sender before sharing information helps protect your account.

Fake banking websites and mobile apps

Cybercriminals create fake banking websites and apps that mimic real ones to steal login details and sensitive data. These fake apps often spread through unofficial stores or phishing sites and may also contain malware disguised as legitimate downloads.

What’s more, vulnerabilities in app design can even make real banking apps susceptible to exploitation. This is especially true where third-party components are involved.

Malware, spyware, and keyloggers

Malware is harmful software that can damage your device or steal your information without you noticing. Spyware is a type of malware that spies on your online activity, including passwords and websites you visit.

Keyloggers are programs or devices that record everything you type, like passwords and bank details, making them especially dangerous for online banking security.

These threats often come through fake emails, dangerous links, or attachments. They can also be installed physically on unattended mobile devices.

Spotting malware can be hard, but signs include slow device performance, delays when typing, or strange errors. The best defense is using trusted antivirus software, keeping your system updated, and avoiding suspicious files or links.

Brute force attacks

Brute force attacks involve trying many username and password combinations until the correct one is found. These attacks can include simple guessing, dictionary attacks, hybrids (mixing words with numbers), reverse brute force (known password tested on many usernames), and credential stuffing (using stolen credentials on other sites).

Attackers often use automated tools to speed up this process, making it easier to try thousands of combinations quickly.

Once cybercriminals crack your login details, they can access your finances directly. This means they could make unauthorized transactions, steal money, or misuse your personal financial information.

Skimming

Skimming is a technique where criminals use small devices called skimmers to secretly capture credit or debit card data. They’re often placed on ATMs or gas pumps. Some skimmers also have fake keypads or hidden cameras to steal PINs.

These devices are getting harder to detect, especially on exposed card readers like those at gas stations. To protect yourself, always watch your card carefully when using these machines and cover the keypad when entering your PIN to prevent others from seeing it. Also, avoid using machines that look tampered with or damaged.

How to protect your bank account

Protecting your bank account from fraud and theft is more important than ever. Banks implement many security measures, like fraud monitoring and encryption, but there are also simple but effective steps you can personally take to keep your money safer.

Use a unique password for each account

Your password is the first line of defense for your bank account, so it’s important to make it strong and unique. Avoid using the same password across multiple accounts, because if one gets compromised, cybercriminals can try that password on your other accounts and gain access.

A good password mixes uppercase and lowercase letters, numbers, and special characters. Aim for passwords longer than 12 characters and avoid easy-to-guess details like your name, birthday, or pet’s name.

Overall, using a complex, unique password for each account makes it much harder for cybercriminals to break in and helps keep your money and personal information safe.

Consider a reputable password manager

Keeping track of unique, unguessable passwords for all your accounts can be difficult. A password manager like ExpressKeys helps by generating complex passwords and storing them securely in one place.

This way, you only need to remember a single master password to access all your logins, making it easier to use different passwords for every account and much harder for cybercriminals to find a way in.

Protect your PIN

Your PIN acts like a password for using your debit card and accessing ATMs. Keep it secret and don’t share it with anyone, not even close friends or family.

Many banks assign you a PIN when you get your card, but you should change it as soon as possible to something more secure.

Avoid using obvious numbers, such as your birthdate, part of your phone number, or predictable patterns like "1234." And when entering your PIN in public, cover the keypad with your hand to block anyone from seeing the numbers.

Create strong answers to security questions

Security questions add an extra layer of protection by helping verify your identity when you need to recover your password or update your bank account. However, not all questions are equally secure.

Choose questions with answers that are:

- Hard to guess: Avoid using information others can potentially find, like your pet’s name or the name of your first school.

- Consistent over time: Pick questions where the answers won’t change, such as the name of your first school teacher, rather than favorites that might change, like your favorite color or song.

- Memorable but private: The answer should be easy for you to remember but not something you share in everyday conversation or on social media.

Good examples include:

- What was the name of your first childhood friend?

- What’s your grandmother’s birth year?

- What was your childhood best friend’s nickname?

Questions to avoid include:

- What color do you like the most?

- What’s your favorite TV show?

- What year did you enter college?

Enable multi-factor authentication (MFA)

Adding MFA to your bank account significantly boosts its security. Many banks now offer MFA as an option within your account settings, and enabling it helps to prevent unauthorized access and reduce the risk of fraud.

MFA requires you to provide something in addition to your password when logging in, such as a one-time code sent to your phone or a biometric scan. This makes it much harder for cybercriminals to gain access, even if they have your password.

MFA methods

- SMS codes: You receive a time-sensitive code via text message to enter when logging in. While widely used and convenient, SMS can be vulnerable to SIM swapping or interception.

- Authenticator apps: Apps like Google Authenticator generate rolling codes you enter to verify your identity. These apps offer stronger security than SMS but require a smartphone and can be susceptible to interception if the phone is lost or stolen.

- Biometrics: Fingerprints and facial recognition are tough to fake. But if someone manages to steal that data (via a database breach, for example), you can’t change it like you can a password. Plus, there are privacy concerns since this info is very personal.

- Security keys: Physical tokens you insert into a device for authentication offer a high level of security because they’re resistant to phishing and can’t be copied. That said, they can be lost or stolen.

Why MFA alone may not be enough

Not all MFA methods offer the same protection. Some, like SMS and email links, are vulnerable to interception or social engineering, for example.

Experts recommend choosing phishing-resistant MFA options like hardware security keys that are compliant with standards like FIDO2 for the best protection. Combining multiple MFA methods, such as biometrics with authenticator apps or security keys, can also enhance security.

Best practices for securing your devices and banking apps

1. Regularly update your mobile and desktop software

Keeping your devices and software updated is one of the easiest ways to protect your bank account. Updates fix security gaps that cybercriminals try to exploit. If you delay or ignore them, you leave yourself open to attacks.

This applies to your phone, computer, and banking apps alike. Updates not only improve performance but also close security gaps that could let malware or spyware steal your information or passwords.

To make it easier, enable automatic updates whenever possible. This ensures your devices get the latest protections as soon as they’re available, helping keep your data safe without you having to remember to update manually.

2. Install anti-malware protection

Antivirus software helps protect your devices by detecting and removing threats like viruses, spyware, ransomware, and keyloggers. It continuously monitors for suspicious activity and blocks harmful files before they cause damage.

Keeping antivirus software updated is essential, as new threats emerge constantly.

3. Use official banking apps only

Using only official banking apps keeps your information safer. Banks build these apps with strong security measures, including encryption and regular updates that fix security holes.

Fake apps can look almost identical to real ones, but they’re designed to capture your login details and personal info. And while it’s safest to download apps only from the Apple App Store or Google Play Store, malicious apps occasionally slip through their review processes.

To stay safe, always check app ratings and reviews, verify the developer’s identity, and be cautious if an app requests permissions that seem unnecessary for its function. If something feels suspicious, avoid downloading or uninstall the app immediately.

4. Enable remote wiping

Remote wiping lets you erase data on a lost or stolen device from afar. This helps protect your sensitive information if your phone, tablet, or laptop goes missing. The device must be turned on and connected to the internet for the wipe to happen. If it’s offline, the wipe starts as soon as it reconnects.

5. Use biometric authentication or a strong PIN on your device

Many modern devices offer biometric authentication methods like fingerprint scanning or facial recognition to gain access. These methods use unique physical features, making them difficult to copy or steal.

If you use a PIN instead of biometrics to unlock your device, make sure it’s not something easy to guess, like your birthdate or simple sequences such as “1234.”

6. Install an ad blocker

Ad blockers stop malicious ads before they reach your device. Many of these ads hide harmful code or lead you to fake sites trying to steal your banking info.

Using an ad blocker helps you avoid these threats while you browse and can also speed up your browsing by reducing the amount of data your browser needs to load.

If you want an easy way to avoid ads, ExpressVPN includes a built-in ad blocker that helps minimize ads, including harmful ones.

7. Open multiple accounts

Storing all your money in just one account can leave you more vulnerable to financial loss. If someone manages to hack your account or steal your card details, your entire savings could be at risk. By dividing your funds across multiple accounts, you can reduce the impact.

Using several accounts also helps you organize your finances better. You might keep one for everyday spending, another as an emergency fund, and a third for savings or investments. This kind of separation makes it easier to monitor where your money goes, follow a budget, and work toward your financial goals.

8. Use a VPN for online banking

A reliable VPN can protect your sensitive banking information, which is especially vital when using public Wi-Fi networks. VPNs encrypt all your data, preventing attackers from eavesdropping on your activities and helping secure your banking sessions.

ExpressVPN is a trusted provider that offers strong encryption and security features designed to keep your online banking safe. It helps to ensure that all your data remains private and secure.

Safe banking on public networks and shared devices

Dangers of public Wi-Fi and shared computers

Using public Wi-Fi or shared computers for banking comes with serious risks. Public Wi-Fi networks, like those in cafés, airports, or hotels, often don’t require a password and may not encrypt your data. This means anyone else on the same network can potentially see what you’re doing online, including your sensitive banking information.

Cybercriminals exploit these weaknesses through techniques like MITM, where they silently intercept the communication between your device and the bank. What’s more, fake Wi-Fi hotspots can trick you into connecting to a malicious network, inadvertently handing over your personal data to criminals.

On shared computers, if you don’t log out properly or clear your browsing data, others can find saved passwords, cookies, or session info and use them to access your accounts without your permission. Plus, public devices might already have malware or keyloggers installed to capture your keystrokes.

Because these attacks often leave no obvious signs, many people don’t realize their accounts have been compromised until it’s too late. That’s why using public Wi-Fi (without a VPN) or shared computers for banking is a risk that’s rarely worth taking.

How to spot suspicious bank account activity

Being alert to signs of suspicious activity can help you catch problems early and protect your money. Here’s what to do.

Set up real-time bank alerts

Banks use automated monitoring systems to detect unusual activity on your account in real time. If something suspicious happens, like a large payment or a transfer from an unfamiliar location, it can be flagged immediately. This helps stop fraud early and protects your money.

As a bank user, you can usually set up alerts through your bank’s website or mobile app. Most banks let you choose what types of notifications you want and how to receive them: by email, text message, or app notification.

Common alerts to consider signing up for include:

- Transaction alerts: Notifications for transactions above a certain amount, international purchases, or transactions made without your physical card.

- Login alerts: Alerts when someone logs into your account from a new device or unfamiliar location.

- Balance alerts: Notifications if your balance drops below a set amount or if large withdrawals occur.

- Password change alerts: Alerts to let you know when your password has been changed.

Review monthly statements for unauthorized charges

Checking your bank statements every month helps you spot any charges you don’t recognize early.

When reviewing, look closely at all transactions across your accounts. Watch for anything unusual, like unexpected charges, unfamiliar withdrawals, or recurring payments you don’t recognize. If you see something suspicious, contact your bank immediately to report it.

What to do if you suspect bank fraud

If you suspect you’re a victim of fraud, acting quickly and knowing the right steps can help protect your finances and limit any potential damage.

Contact your bank immediately

If you notice suspicious activity on your account, contact your bank’s fraud prevention department right away. Provide details of any unauthorized transactions or suspicious communications.

Your bank may freeze affected accounts, issue new cards, and start an investigation to protect your funds and maximize your chances of recovering lost money.

For more details on when and how banks reimburse scam losses, see ExpressVPN’s comprehensive guide on bank refund policies after fraud incidents.

Change your passwords

If fraud is suspected, you should change the passwords for your banking accounts and any related services immediately. Use strong, unique passwords for each account and enable MFA as an added layer of security.

File reports with local and federal authorities

Reporting suspected bank fraud to the appropriate authorities is a crucial step in protecting yourself and helping prevent further fraudulent activity. Depending on your country, this may include local law enforcement, national financial regulators, or consumer protection agencies.

Place a fraud alert or freeze your credit

If you suspect fraud or identity theft, placing a fraud alert on your credit report is a helpful first step. In the U.S., you only need to contact one of the three major credit bureaus (Equifax, Experian, or TransUnion), and they’ll notify the other two for you.

This alert requires businesses to verify your identity before opening new accounts in your name. There are different types of fraud alerts: an initial alert that lasts one year, an active-duty alert for military personnel, and an extended alert lasting seven years for confirmed identity theft victims. Fraud alerts don’t impact your credit score, but they might slow down credit applications because of extra identity checks.

Another option is a credit freeze, which blocks most lenders from accessing your credit report, making it difficult to open new accounts unless you lift the freeze. Unlike fraud alerts, you’ll need to contact each credit bureau individually to freeze or unfreeze your credit. A credit freeze won’t affect your credit score.

Choosing between a fraud alert and a credit freeze depends on your situation. If you plan to apply for credit soon, a fraud alert offers protection while allowing lenders to check your credit with extra verification. If you don’t expect to need new credit in the near future, a freeze provides stronger security.

Monitor your identity

Keep an eye on your identity by checking your credit reports regularly. Look for accounts or inquiries you don’t recognize. You can get a free report once a year from official sources like annualcreditreport.com. Catching problems early helps you act before things get worse.

ExpressVPN customers in the U.S. can also take advantage of ExpressVPN’s Identity Defender tools, which include a credit scanner, ID alerts, ID theft insurance*, and data removal.

FAQ: Common questions about securing your bank account from hackers

Can banks reimburse stolen funds?

Many banks have policies to reimburse customers if fraud is reported promptly. Banks usually investigate and may freeze accounts or issue new cards as part of the process.

Can I secure my bank account without using apps?

Yes. You can protect your account by using strong, unique passwords, enabling multi-factor authentication (MFA), monitoring your accounts regularly, and setting up alerts via SMS or email. Using secure connections and staying alert to suspicious communications also helps keep your account safe without relying solely on apps.

What’s the safest way to access online banking?

Use secure Wi-Fi networks and keep your devices updated. Enabling multi-factor authentication (MFA) adds extra protection. Also, use strong passwords and be cautious of phishing attempts.

Are digital wallets safer than credit or debit cards?

Digital wallets offer better security by encrypting your payment info and using unique codes for each transaction. They often require extra verification, like biometrics or PINs. However, how safe they are depends on the provider and how carefully you use them. Still, they reduce risks like card skimming and stolen card numbers.

How do I stop scammers or hackers from accessing my bank account?

Use strong, unique passwords and enable multi-factor authentication (MFA) on your accounts. You should also monitor your accounts for unusual activity and set up alerts, avoid sharing sensitive information, and be cautious with emails or calls asking for personal data.

Is it safe to use password managers or biometrics for online banking?

Yes, password managers help create and store strong, unique passwords, reducing security risks, and biometrics like fingerprints add extra protection by verifying your identity.

What should I do if I notice suspicious activity on my account?

If you see any suspicious transactions or activity on your bank account, contact your bank immediately to report it. Review your recent statements carefully and set up account alerts to monitor future activity. It’s also wise to check your credit report for any unfamiliar activity and to change your login credentials.

*The insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Array US Inc, or its respective affiliates for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN

Comments

Hi Javier, please contact our Support Team and they will get you get connected.